You can also listen to our recent podcast “Should you buy a house” here

The question one often asks when one gets to a comfortable state of personal affairs is: Should I rent a house or buy one?

All your friends are buying houses, or at least have “booked” them. There are good sentimental reasons to do so – owning a house ensures a tiny element of piece of mind – you can change things you don’t like, like the drawers in your kitchen cabinet, or the paint on the walls, or add wooden flooring or a bathtub and such. But does it make financial sense to do this?

There are some advantages of each, but I shall take the Indian perspective. Here’s where we are with Renting:

- Renting in India typically costs less than 3% of a house value. Meaning, if a house’s market value is Rs. 50 lakhs, the rental will be around Rs. 15,000 per month.

- Tax breaks are available: Around 40% of your basic salary (or the rent, whichever is lower) is deductible from your taxable income.

But there are tax advantages for buying too. Here’s where we are:

- Payments on Interest upto Rs. 150,000 per year is tax deductible.

- Principal repayments are tax free upto Rs. 100,000 per year. (Section 80C)

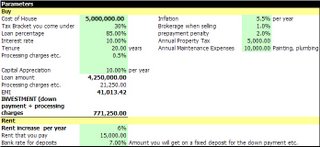

Let’s see the comparison for a Rs. 50 Lakh house. I’m assuming that if you were to buy this house you will have a certain amount as “down payment” and pay a much higher EMI per month than the corresponding rent (Rs. 41,000 EMI, vs. Rs. 15,000 rent). If you rented, the extra money goes into the bank as a saving, and so does the down payment.

The return analysis on this, is in an excel sheet I have built, but here’s the summary:

Key points to note:

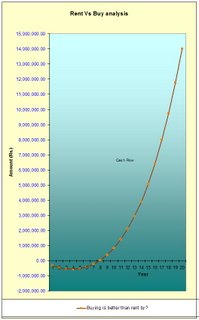

- Cash flow wise, Renting is better for the first 8 years.

- After 8 years, buying is better, and after twenty years, the bought house is better by Rs. 1.4 crores!

- The equation is skewed to some extent because of the limits on the tax saving. The limit of Rs. 150,000 on the interest is too low – for the first 15 years, you pay more than 150,000 interest per year.

- Even the principal paid is more than 100,000 per year, so the tax saving there is limited too.

(Download the real estate calculator excel sheet)

If you’re in for the long term you should buy, but remember this: If you think the prices will stabilize or come down in the next eight years, delay your decision to buy. After all, renting is far more cheaper and you will have much more money saved up in the longer term.

Also, be more aggressive in your investments to give you a better return, and therefore a better down payment.

Finally, remember that owning your house is important for sentimental and personal reasons too. The happiness you can derive from having an own house perhaps outweighs financial reasons.