From Assessment Year 2007-08, tax filing for year 2006-07, you will need to use new IT return forms. These are downloadable from the Income Tax Department web site.

No more “saral” business – the number of forms have increased somewhat and things may be confusing.

The forms are numbered ITR1 to ITR8 and if you choose to file electronically (discussed later) you can use ITR V. FLet me do some basic fundas of tax filing with these new forms.

No more Form 16 and Form 16 A attachments

Salaried persons usually get a Form 16 from their employer. From now on, the Form 16 needn’t be submitted with the IT Return. You need to fill in the relevant details in the tax form itself.

What forms do I use?

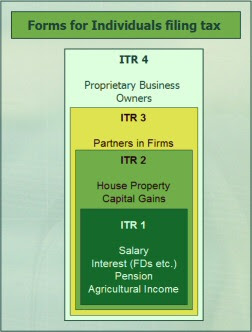

There are a number of forms, arranged as subsets.

ITR 1 is for people with salaried income, Income from interest (FDs, NSCs etc.), Pension and/or Agricultural income. This form has Version 1 and Version 2, both are the same except the latter is more broadly laid out. (Instructions)

If you have Income from capital gains (short or long term, even if it’s not taxable) you must use ITR 2. This form is also used if you have rented out a house and have rental income. If you own a house and live in it, and want to claim deduction of Rs. 150,000 on the interest on the housing loan, you must use this form. It’s a superset of ITR 1, meaning that if you have salary and income from house property, you can use this form. (Form, Instructions)

For those of you who are partners in partnership firms, use Form ITR 3. This is a superset of ITR 2, and contains fields for income from all your firms where you are a partner (regardless of whether this is taxable or not). (Form, Instructions)

And for owners of proprietorships, there is ITR 4. (Form, Instructions)

Annual Information Return (AIR)

Section 24 in ITR 1 and Schedule AIR in the others is a section you must fill up if you have:

- Cash deposits aggregating to Rs. 10 lakh or more in a year in any savings account in any bank

- Credit card payments aggregating to Rs. 2 lakh or more in the year.

- Purchase of mutual fund units of more than Rs. 2 lakh in the year (not clear whether it is for one fund or across all funds)

- Purchase of Rs. 5 lakh or more worth of bonds or debentures.

- Payment of Rs. 1 lakh or more towards purchase of shares of a company

- Purchase or sale by you of any immovable property valued at Rs. 30 lakh or more. (This includes houses, apartments etc)

- Payment of Rs. 5 lakh or more towards RBI bonds.

You have to fill the aggregate amounts under each of the above (each of which has a code) All authorities of the above (banks, registrars, RBI, Mutual funds etc) are supposed to provide an AIR of all those people who qualify under the above. The IT department will match their returns with yours and I think they intend to find those who don’t declare such investments and assess them closely.

No more duplicates

You do not have to submit two copies of the forms. There is an “acknowledgement” which is enough to state you have made the return. But for your own sake maintain copies of what is filed.

Due Date: July 31, 2007

You should submit returns by the due date, otherwise strange things will happen. And you’ll have to pay interest at 1% per month (non compounded).

If enough people want detailed instructions I will give it a shot.