Bank of Rajasthan to merge with ICICI Bank (Livemint)

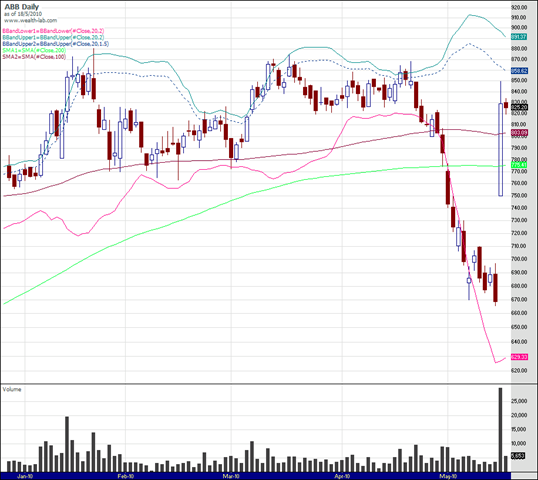

ABB Switzerland decides to buy a 75% majority in ABB India in an open offer at Rs. 900 per share. Stock spikes 24% to 829 from 668. The Acceptance ratio will be about 50% if all shares are tendered, since ABB already owns 52%; so there’s no value in there now.

L&T Announced Decent Results (44% growth in profits, 41% on consolidated EPS to 90.16 ) Raw material costs are rising, but their order book of one lakh cr. is very strong. And the 18 P/E looks cheap on the face of it. (Disclosure: I’m long with F&O in a short term trading system, hold some stock)

VC Circle: Gridstone Research is finito, Reva may be sold for $100 million. (HT Kaushik Gala)

Suman Bery on Greek Lessons for India. His sum-total argument seems to be that it’s okay to have high debt to GDP as countries like Japan have survived, and India needs to understand that boss, we’ll have high debt so we need to keep our current systems of low FII participation in gov bonds, high SLRs so there is always a market for govt. debt, and high regulation of capital movements. I disagree. We may need those measures in part, but not in the draconian way we have them. Foreign investment in govt. bonds is about 1% of the total and about 2% of our forex reserves. ECB and weak-rupee measures hurt our economy because we’re 60-80% internal. We can do with more, not less, and if we used the figures, we can see how much we’ve really lost in opportunity cost. Another post, another day.