IRDA, the regulator I have torn into over ULIPs, has started to get investor friendly. And how! The latest piece is a notification for early surrender.

If you stop payment on your policy – regardless of when you do so – your policy will be considered “discontinued”. An insurer can contact you to continue the policy within 30 days of the premium date, but should you not respond, the policy is considered discontinued.

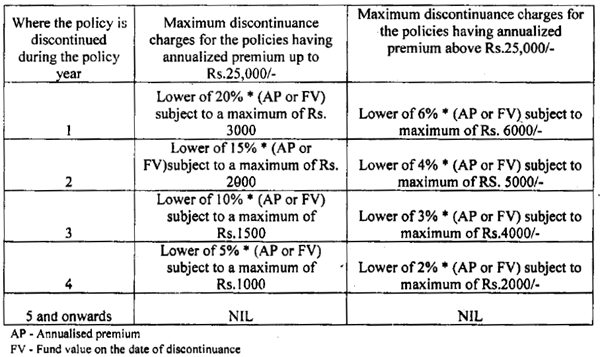

Then, the fund value is frozen in the account, and paid out only after the “lock-in” period, which is a minimum of 5 years from the start of the policy. The money earns 3.5% in the interim. They can deduct a maximum of Rs. 6,000 as charges for such “surrender”.

Plus, there no such charges on top ups or single premium policies.

This compares very well to current norms where insurers charge even 100% of the fund value as surrender charges. Awesome.

This is effective immediately, only for new products issued from now on. That means older products will still have onerous surrender charges.

Mint reports this screws up Insurance companies:

The insurance regulator’s move to cap surrender charges on unit-linked insurance plans, or Ulips, will hurt life insurers where it hurts the most. Insurers’ income could drop by as much as half because of the move, which may require them to infuse more capital and delay their break-even, industry executives and experts say.

When half their business depends on customers discontinuing their policies, what can you say?

This is a sea change in IRDA – a clear choice they have taken in the investors benefit while forcing the business providers (insurers and agents) to rethink business plans. Much required, and I’m sure, much appreciated.