[Warning: Long post]

Reader A writes in, about my note on Commission Oriented Advice:

Just read your note below and I must say I’m a bit confused. I don’t know about investing a lump-sum(like 3 lacs) but from my understanding (w/o looking at commission structures) is that MIP’s offer a good start for the lay-man investor. I’ve been advising a few clients on going for MIP’s. To me getting in to a MIP is a good start. There’s a good safety margin and at the same time a decent equity exposure. Now the fact that I make a commission from this is different. That doesn’t take away from the fact that MIP’s might actually be good investment vehicles.

Most of my clients have already got some savings plan going( like an RD or an insurance scheme- not my advice but already started!) and now they want to start looking at investing in equity. I tell them to start on MIP’s so that they’ll know if they can stomach the risk. So now the guy after investing in MIP’s for sometime and getting some exposure can decide if he is comfortable taking more risk and therefore can move some of his money from his MIP to some other equity plan through an STP. (or maybe move all of it in one shot to something else!). Yes I must be aware that there’s a min 1 year lock-in period and be sure that my client is not penalized for the same.

I might be making commissions from his investments but that doesn’t take away from the fact that this might actually be beneficial for him. If my suggestions to him go wrong then I’m the guy who’ll take the hit as I won’t get any more references from him.

I think to dismiss all guys who get a commission on investments made is wrong. I remember in an earlier article you mentioned that the mutual fund advisory business can actually be profitable provided that the advisor charges something like Rs. 10,000/- as advisory charges per client. Now for the average Joe who’s probably going to invest only 10K-40K in the whole year that is simply not plausible.

I admit that the commission structure is not perfect and there are a lot of ethical issues. But judging investments decisions/advice by looking at commission structures is getting paranoid about the whole thing.

A makes many points and it’s important for me to be where I stand.

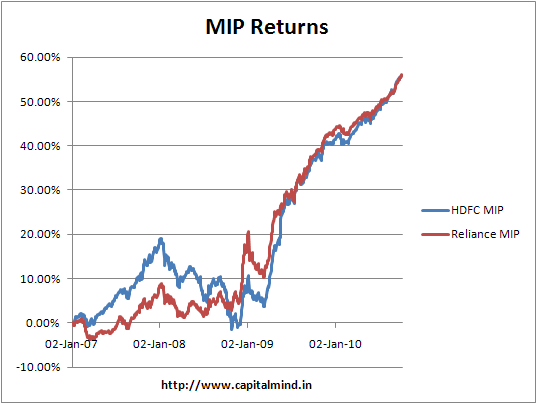

Getting to an MIP is a good start for someone to get used to Equity as an asset class: This could be true, but let me chart the returns of the top two MIP funds from Jan 2007 (and they were top then too, if I recall correctly)

The returns are normalized from 1 Jan 2007, and this is the growth plan. Note that the return is cumulative (not annualized), and shown as a percentage of the Jan 1,07 NAV. Have not considered entry loads etc.

As you can see, being invested in HDFC MIP would have shown an investor a steep 20% drawdown – that is, an investor getting in on Jan 2008 would have lost 20% of his money till Jan 09, and only then recovered. Even with the Reliance MIP, the drawdowns have been of the order of 10%. These are substantially lower than the actual equity drawdowns, so yes, the investor might feel slightly better, but in my experience the first thing people do when they experience a loss (especially those not used to the equity asset class) is to say: Get out of equities. It’s their money, so you have to do what they say – and they will lose more money on exit loads.

To educate a consumer, a better strategy is to simply tell them to put 20% of their money into a diversified equity fund and the remaining in a regular debt fund. On a lark I plotted an SIP of Rs. 10,000 each into the two above MIPs versus a self allocated 20% to HDFC Equity Fund and 80% to HDFC Short Term Debt fund.

The difference is marginal (about 10K between each after 46 months, nothing to write home about). Consider that a self managed strategy offers

- Greater liquidity (no exit load on the debt fund, equity loses exit loads in a year), so the investor can get out easier without paying a bomb.

- The ability for the investor to exit only equity or only debt, and solves the second problem (moving slowly from a debt oriented portfolio to equity)

- The ability to rebalance as per one’s requirements – the advisor can do this, if he feels that instead of 20% equity, an investor should scale to 40% equity, it’s easy – just move stuff around. Can’t do that with an MIP.

For an advisor, this is the kind of advice which investors are even likely to pay for, compared to just recommending a random product. You will hardly get points for saying “buy an MIP”, and so you will have to rely on mutual fund commissions, and you’ll be unhappy with SEBI for removing entry loads and so on.

An MIP is supposed to meet the “average” customer need, but no customer is ever “average”. Customer needs change over time and so the solution is to have a strategy that’s flexible.

Having said all this the last point is important: I think to dismiss all guys who get a commission on investments made is wrong. This I agree with – you should not decide about buying a product based on commissions alone. And the other point – that the average customer who invests 10K to 40K a year is unlikely to pay the 5K minimum required: This is also correct, but that means the 10K to 40K person isn’t going to be a great commission client either; a purely money-driven exercise will necessarily throw this person out as a customer too.

In any case: It’s strange to advise an investor to put money into a fund that’s 80% debt, 20% equity, and then move it after a year, slowly, into a fund that’s 100% equity. Very strange indeed, and the light bulb comes on when you hear about commissions.

(Note: this is not advice.)