If the Nifty closes positive today, it will be the sixth consecutive day it has closed up. Does this usually signify a turnaround?

The answer can only be gotten from past data. Let’s see what happens in the past if we look at six day continuous positive days and find out what happens on the day after that. I took the Nifty data since 1994, and did a quick back-test.

Assume that if the nifty is up 6 days in row, I buy it on the Sixth day, and sell it on the immediate next day.

|

Continuous Positive Days |

6 |

|

Total Return |

7.80% |

|

Positive |

30 |

|

Negative |

31 |

|

Number of Instances |

61 |

|

|

3.8125 |

|

Avg Positive Return |

1.18% |

|

Avg Negative Return |

-0.89% |

|

Expectancy |

0.13% |

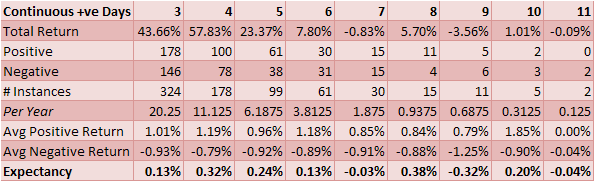

There have been a total of 61 such instances, about 4 times per year. That means this is a very low frequency signal.

The Win-Loss Ratio is roughly 30-31 – meaning you get a 50% chance of winning. But the expectancy (or the expected return per trade) is a positive number – 0.13%.That’s because the Average Win is 1.18% while the average loss is only -0.89%, meaning you make more when you win and lose less when you lose.

0.13% is horribly low and I haven’t even considered commissions or slippage. And with about four instances a year, with a 50% win ratio, it’s not even worth betting anything on. With so few instances, you can’t even make a solid conclusion, honestly.

< p>But the best time may have been over. Look at various return characteristics of Continuous Positive Days:

The best time seems to be the 4 or 5 day period. That means, had you bought on Friday or Monday, the chances of a positive return were much higher. Both the win-loss ratio and the odds (what you make when you win versus what you lose when you lose) are in your favour for 4 and 5. With about 178 and 100 instances, there is slightly more to rely on; but before you blindly rush to put in money behind a "system" like this one, ask:

1) Is the return skewed towards a few hugely positive instances (or negative ones)? One trade with an 80% return can negate 80 trades with -1%.

2) Is the standard deviation too high? That means is the 0.32% a function of 10 returns varying from +60% to -40% or something like that? Or is it a narrower band? The lower the return volatility (at least, on the downside) the better.

3) Is this reliable? If you’re into systems, you might want to check out Henry Carstens’ P&L Forecaster to see reliability when run multiple times.

Do post your thoughts.