[blurb-capmind-prem]

Some great links I’ve found on twitter:

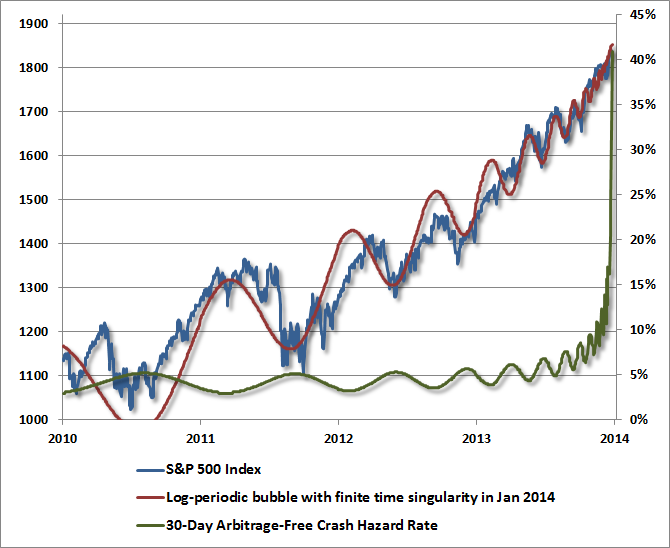

Hussman funds on Estimating the Risks of a Market Crash. They calculate the probability of a crash based on the structure of immediate past data, and the recent data on the S&P indicates that the probabiity of a 25% crash is soaring.

(My note: A probability of 99% still means it might not happen. But when you combine it with the general bullishness of commentators, it seems like a crash will come when it’s least expected.)

A One-hour video by John Bollinger on Bolllinger Bands, Band Widths and so on.

29 Dumb Things Financial People Say. I’m guilty of some of these as well! However I’m with them on things like “This is a cyclical bull market in a secular bear”, or “Earnings were positive before one-time charges” or even “Earnings Missed Estimates”. Earnings estimates are a complete load of bull and no one, including the companies that issue guidance, gets them right.

Dave Barry’s Review of the Year 2013. Not only financial of course.

Banks don’t really push RBI’s CPI inflation linked bonds, says ET.

Brett Steenbarger on “Why do you trade?” About how traders that view only money as a motivation tend to slump or freeze when they go through a losing streak, and the need for a larger goal. Trading is a profession, and if you don’t derive satisfaction from the job itself – call it a thrill, or call it the joy of doing what you love – you will not tend to succeed. Money, though, is an important motivator, IMHO.

The Mandi Grip on food prices (Business Standard), and how they stiff both retail buyers and farmers. But don’t blame the middlemen – blame the laws that give them leeway. Disband the APMCs, disallow strong arming by the middlemen (put them in jail if they use force) and allow farmers to sell to whoever they choose.