The Government will buy back bonds worth 15,000 cr. next Tuesday (March 18).

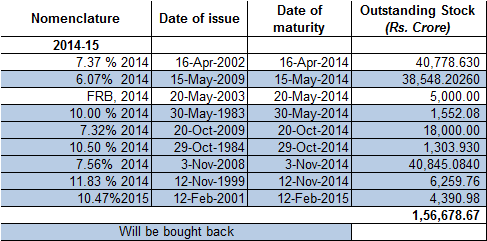

I have maintained for a while now that the repayment balloon in government bonds will be huge in 2014-15. Inspite of a recent bond-swap by the RBI (details of which I’d noted in Capital Mind Premium) of Rs. 27,000 cr. to the 2043 bonds, we have a huge load in the coming year.

[blurb-capmind-prem]

This load is concentrated in a few months. April and May alone account for about 85,000 cr. that needs to be repaid.

(Source: RBI)

The buyback will still retain Rs. 1,40,000 cr. to be repaid in 2014-15.

Where will the government get the money from? Advance taxes. Corporates will pay up in March and that money sits in the government account with the RBI till it’s spent. According to the last weekly supplement, as of Feb 28, 2014, the government had very little money lying with the RBI – only 101 cr. So most of this buyback money comes from advance taxes.

The overall redemptions in the next few years are quite heavy:

Impact of the buyback: There will be more liquidity to the banking system. Tax money paid to the government’s RBI account is not available to banks to lend out. Effectively, this buyback gives banks money earlier. (On 16 Apr, the government would have to pay back Rs. 40,778 cr. anyhow, plus accrued interest of around 1,500 cr. as interest is paid every six months)

In April and May there will not be large spending (the elections don’t cost us that much) and the repayments will drain out the government’s coffers. We will have to issue a LOT of bonds in the coming financial year, if the new government is to have any wiggle room.

Subscribe to Capital Mind:

To subscribe to new posts by email, once a day, delivered to your Inbox:

[wysija_form id=”1″]

Also, do check out Capital Mind Premium , where we provide high

quality analysis on macro, fixed income and stocks. Also see our

portfolio which has given stellar returns in our year, trade by trade

as we progress. Take a 30-day trial:

[wysija_form id=”2″]