DLF has launched India’s first Commercial Mortgage Based Security (CMBS) by securitizing the lease rentals on two malls in Vasant Kunj in Delhi, DLF Emporio and DLF Promenade. DLF will receive Rs. 800 cr. for a period of 7.5 years, where interest is paid through rents received from tenants of the property.

How CMBS Works

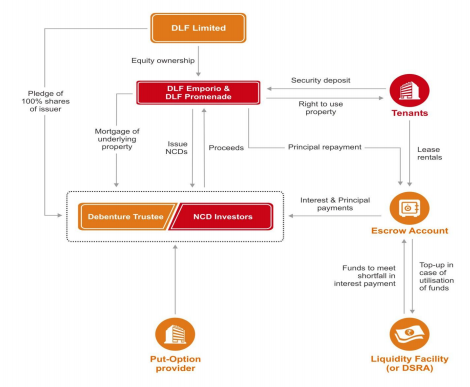

The idea is that the mall owner (DLF) issues Non Convertible Debentures (NCDs) to investors and gets money immediately.

Then, to pay off the interest each month, it sends the lease rentals of a mall to a single escrow account, which first pays off the interest portion to the CMBS debenture investors.

At the end of the CMBS Period, DLF will pay off the principal. (As a “bullet repayment”)

Crisil has rated the debentures AA, and has the following diagram.

What happens in case of a shortfall or default?

Supposedly, this CMBS has a coverage ratio of 1.7 to 2 – meaning, the lease rentals will by 1.7x to 2x the required monthly interest payment. For example, if the interest rate on the debentures is 15% a year on Rs. 800 cr, then the interest payment per month is Rs. 10 cr. But the rentals will pay between 17 cr. and 20 cr. per month (in the two malls put together), according to Crisil.

If the lease rentals can’t cover interest for any reason (lack of occupancy or default by renters), there is a “DSRA” (Debt Service Reserve Account) with three months of interest payments that will kick in.

There is a put-option provider who is supposed to pay back the principal+interest in case there is a longer default.

If the put provider doesn’t pay, the debenture holders can enforce the mortgage on the properties (that is, to sell the shops or the malls).

And beyond that, there’s also shares of DLF that are pledged, which can be sold.

Also there can be no further debt taken by using the properties as mortgage.

So it’s a multi level protection against default. Of course, if there is a major crisis, none of these will have value (the property may not be worth much) and DLF shares will be in the toilet.

Who’ll invest?

It will be institutions for the most part. Hedge Funds, Realty funds, PE funds and foreign investors, and possibly HNIs as well. I doubt retail can play a part.

Notes, Risks and Benefits

Malls have three sources of revenue:

- Parking

- Lease rentals

- Revenue share with restaurants/shops

Only the lease rentals and revenue share has been pledged. Not the parking fees, or monthly maintenance fees, from what I can glean. Even the security deposit is not going to be held by the debenture holders. DLF benefits by continuing to have some revenue streams to themselves and get upfront cash of Rs. 800 cr.

We don’t know the costs of the debt yet (interest rate) but if it’s lower than what DLF is paying elsewhere, it can retire higher cost debt.

The lease rentals are pretty big in number, if we assume the CMBS requires Rs. 10 cr. per month as interest, on a presumed 15% interest on Rs. 800 cr. The malls add up to Rs. 800,000 sq. ft of space. With 75% occupancy I estimate that the malls needs to charge Rs. 160 a square foot per month to be able to service the interest. Currently the rates in these malls are upwards of Rs. 500 per sq. foot per month. (Source)

DLF also has to pay back no principal till the very end (7.5 years later) which helps with cash flow. (Bank loans require partial principal repayment too along with interest). Investors will then get interest on their full investment and have no reinvestment risk. Of course, DLF might default after 7.5 years on the principal, which is the major risk with balloon repayments.

The biggest benefit is to the ecosystem. By securitizing receivables, providing a liquidity backstop and providing collateral, the age of the CMBS is here. More real estate owners may go down this route and deepen the market, plus provide higher yield avenues for investments that are secured in multiple ways as above.

Of course we should avoid the problems that have existed elsewhere. Like, ensuring DLF has not taken other loans mortgaging the same property. Or it is not currently funding other loans with these very lease rentals. And that the papers are proper that DLF owns the property (this is a big pain in India, to verify ownership). Most importantly, that the properties don’t violate environmental or zoning laws, in which case the malls can be shut down and/or razed. (There is then very little recourse left for investors)

DLF Benefits but Profits Might Be Hit

DLF benefits from the deal, where they get an upfront Rs. 800 cr. in exchange for this debt.

However, their profits might still take a hit. My reading is that with the new debenture rules in the Companies Act, they will have to invest 15% of the amount to be repaid each year – in this case, 18% of Rs. 120 cr, or Rs. 18 cr. per year – into government securities. And, they will have to set aside Rs. 400 cr. as a debenture redemption reserve. That will hurt their profits!

(DLF reported a net profit of Rs. 729 cr. in 2012-13)

DLF’s share price has been falling in the last three weeks, and is down to Rs. 152 after being at Rs. 180 in early April. The damage is political it seems, with their alleged ties to the Congress party which might be routed in the ongoing elections.

The CMBS, although a good first step to derisk the company from banks and the banks from a large single borrower, might hurt the company’s financials because of the new debenture rules. But this opens the doors for other players to join.