We all know that FIIs have been buying equities like crazy. How have they been doing on the debt front?

We take a deeper look into their recent activity in debt. Remember SEBI activity notes only purchases or sales. In debt, what they invest in will “mature”; on maturity,any fresh purchases are not really purchases, but only reinvestment of what they had already bought earlier. (Maturity payments are not counted as “sales”)

So in a lot of ways the SEBI data isn’t quite that useful. We take a deeper look at this data, by going into specifics.

[blurb-capmind-prem]

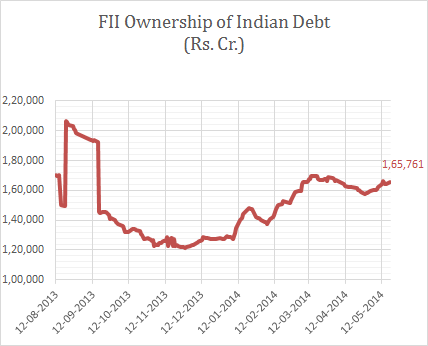

After rising substantially through the first three months, FIIs have cut their holdings in April. Now we’re seeing their holdings rise again:

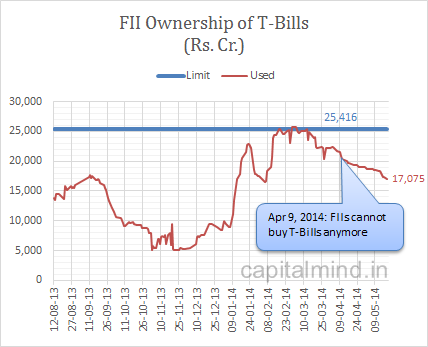

Much of the “drop” was because of the RBI restriction on April 9, that FIIs can no longer buy T-Bills anymore. They’ve been letting that debt mature, and the effective holding has dropped substantially.

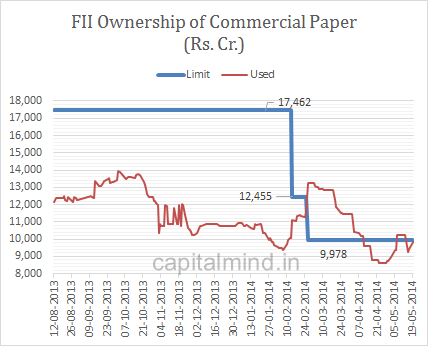

They still like short-term stuff though. T-Bills are government paper with less than 1 year to maturity, and the corporate equivalent is commercial paper (CP). You can see how FII’s like those:

Again, here, the RBI cut their ownership limit down from the earlier $5 bn to just $2bn. Due to a temporary confusion, the limit was set at 12,455 cr. and eventually brought down to 9,978 cr.

Today CP investments are nearly at the limit.

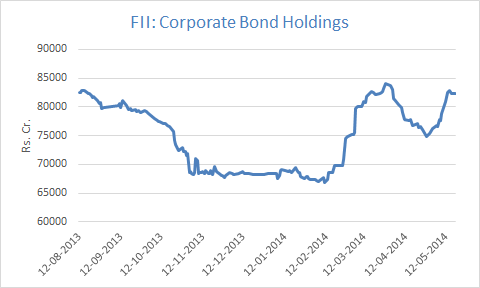

What’s left is Corporate Bonds and longer term Government Bonds (G-Secs). Corporate bonds have made a comeback:

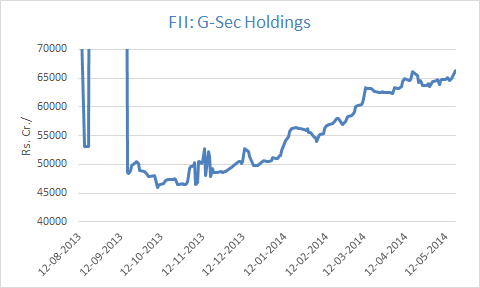

and G-Secs wise, they’ve been steadily adding on to their holdings:

Impact: Debt investments have picked up but they still are way below the levels found before September 2013. With no further investments in T-Bills and CP possible, FII’s have to buy longer term debt. Will they continue to buy?

By the way they bought about Rs. 1500 cr. woth bonds on Monday. It’ll be interesting to see how they behave once the choice for finance minister is announced.