There’s something strange happening in India – and indeed, the world – with longer term rates and bonds. It looks like interest rates are going up!

Indian 10 year government bonds seem to be inching up to the 7% mark. After the recent rate cut (to 6.25% on overnight rates) the 10 year bond had fallen to the 6.72% level, and since then has rallied upwards.

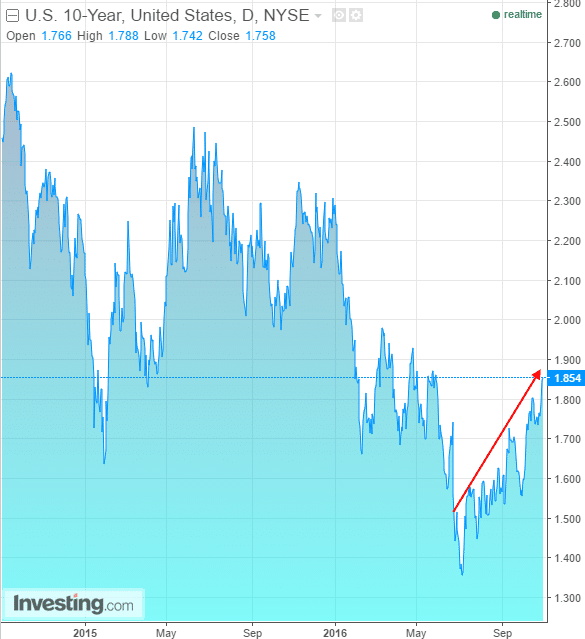

The US Ten Year Bond too has been going up in yields: it’s now at 1.85%, the highest in six months.

For corporates and banks abroad, most loans are linked to LIBOR. The LIBOR has been going up for a few months and 3 month LIBOR is now at the highest since 2009. This is because of a regulatory change (We have a premium post on it) which has caused a shortage of investors in funds that lend to non-government borrowers. LIBOR spikes mean that costs of borrowing are up. ANd then, many loans whose rates are linked (floating rate) to the 3 Month LIBOR are also hit – they pay higher interest.

For corporates and banks abroad, most loans are linked to LIBOR. The LIBOR has been going up for a few months and 3 month LIBOR is now at the highest since 2009. This is because of a regulatory change (We have a premium post on it) which has caused a shortage of investors in funds that lend to non-government borrowers. LIBOR spikes mean that costs of borrowing are up. ANd then, many loans whose rates are linked (floating rate) to the 3 Month LIBOR are also hit – they pay higher interest.

The higher interest rate regime isn’t being countered by insane levels of QE. Bloomberg says that the phenomenon is hitting Europe too, as German bunds have the worst month since 2013.

This may not be a big deal just yet, but it leads into the US Fed’s program to hike rates – which is now a near certain thing in December. That rate hike fears – a “tantrum” of sorts – is what caused some big market crashes – in 2015, and then in early 2016.

The Impact?

Firstly, Gilt and bond fund NAVs will fall. Because when yields rise, prices fall. Why? See our Bond Yield video.

Secondly, bond markets are prescient. They know stuff before equity markets do. So you don’t take a global bond selloff lightly. We have to however see how this develops, and it can take months to hurt.

Thirdly, interest costs are rising slowly. Most corporates were able to see much lower rates in bond markets on the back of falling government yields. Now, they won’t, because government bonds yields are rising. That will change the equation for Indian banks and corporates. For companies borrowing in dollar terms, rates are up nearly 0.5% in a very short span through the rise in LIBOR.

Finally, this is not a panic situation. Anything like this is like saying “I can sense a chill in the air”. That doesn’t mean you go wear six sweaters and buy new heaters. Even if winter’s coming, it’s going to take some time – just be aware, so that you don’t have to be surprised if things take a turn for the worse.