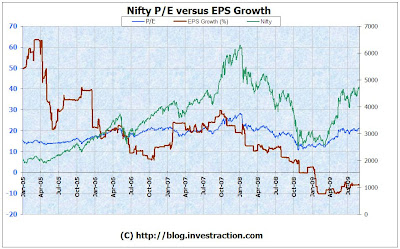

A quick take on the Nifty P/E and EPS growth till now:

(Click for a larger image)

At the 4700 levels we are at a P/E of 20.94, which translates to an EPS of about 223. This is an EPS growth, over the same time last year, of a NEGATIVE 5.89%. (We were at 236.57 last year; that was another lackluster 7% growth from 2007. Take a look at the flattening EPS chart of the Nifty:

(Click for a larger image)

We’ve been flattening on EPS for a while now. In fact, TWO years ago, in 2007, the Nifty EPS was 221.06 – speaking tomes; even the Nifty then was at the 4500 levels. Two years and we haven’t gone anywhere; on the Index OR on the Index EPS. The 9% and 6% GDP growth hasn’t quite impacted our Earnings Per Share, it seems.