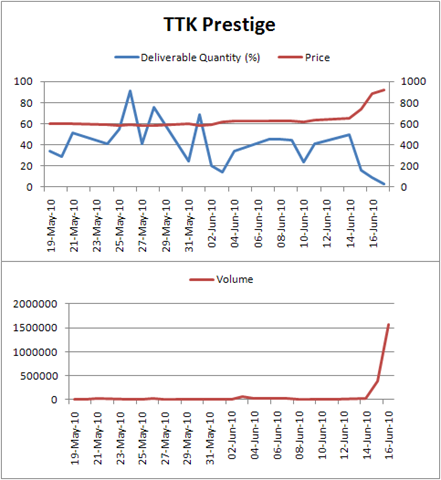

A couple of readers warned me that all was not well in the rise of TTK Prestige I had earlier mentioned. Look at the deliverable quantity, they said. And here it is:

The price shot up from the 600 levels to 900+, and the delivery volumes have gone lower and lower. Yesterday when the price ended up at 923, the delivery percentage of the volume is at a meager 3.26%.

Delivery volumes will get smaller when stocks hit upper circuits – people will book profits on a quick basis. From average turnover values of 1 cr. a day, this stock has moved to 228 crores a day yesterday. Even considering just 3% of delivery, there were 7 crores of delivery volumes; still, about half of Wednesday’s 14 crore delivery volumes.

Also the NSE/BSE arbitrageurs must have made some volume. Here’s the NSE Bulk Deal data.

Looks like about 7 lakh shares out of the 40 lakh traded in the last two days were arbitrageurs.

Not much to conclude except, yes there are arbitrageurs, and if you look at volume delivered, even that has gone up. I’m not sure if it matters that it’s intraday traders or long term holders; volume is important in that it makes the price action significant.

Disclosure: I was long. I sold. I might trade it again. I’m not predicting a fall or a rise.