After a long time we have a setup that looks very interesting.

- Reasonably strong support at 5400

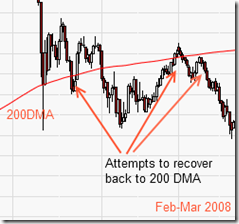

- The downchannel Nifty is in stays intact even if Nifty recovers 200 DMA – which is at 5626, a 100 points away.

- This is, in my opinion, a 70% probability trade – getting close to the 200 DMA. Back tests show a bigger probability as we have bounced back to the 200 DMA a number of times in the last 6 years. But I’m whittling that down.

- The stop loss has to be the support if you went long – at 5400.

- Loss potential : 125 points, chances are 30%, and the upside potential is probably 100 points at the max.

- Which gives you an expectancy of +32 points – a reasonably positive figure. Expectancy = (Win Probability)*(Amount you win) – (Loss Probability)*(Amount you Lose)

- Worthwhile trade, I think, but the setup is very infrequent (Three times in the last six years)

So it did well in the past:

What I don’t like is the lack of upward volume. And the fact that there is too much negative news. If the support at 5400 breaks down, we’ll topple another 200 points quite easily.

I’m taking this trade. Let’s see how it goes. (Disclosure: Long)