Have you ever wondered how traders with big pockets and lots of holdings trade? What if we analyzed some of the Big Whales holdings.. Sorry.. not holdings but tradings?

How do we do this? It wasn’t an easy task. We have to look at the Annual Reports of companies where an investor is reasonably big, and they reveal the additions and removals of shares in the year, of each of the big investors. (Typically, 20 investors or so)

Of the 31 Big Whales, the one Big Whale that made the most sense to “investigate” was the Big Bull himself, Rakesh Jhunjhunwala.

So this meant that we had to look at the Annual Reports of all his invested companies which were 31 in total that we knew of.

You can view the complete portfolio of Rakesh Jhunjhunwala’s holding and 30 other Big Whales in our report here: Portfolios of Top Investors in Indian Stock Market – Big Whales Report – June 2016 (For Purchase, Rs. 999 only).

Of the 30 invested companies (we exclude Tata Motors DVR), we had to exclude many since they were not friendly enough with their data:

- 3 inve

sted companies with transactions showed the transactions without their dates which meant we could never figure out the price at which they were traded.

sted companies with transactions showed the transactions without their dates which meant we could never figure out the price at which they were traded. - 13 invested companies did not have any transactions i.e. changes reported in the Annual Reports which also reconciled to the data published on the exchange. RJ didn’t sell or buy them in the year.

- 5 invested companies did not disclose the transactions though they were traded by RJ during the year since the shares held at the beginning of the year did not match the shares held at the closing of the year.

So now coming to the remaining 10 companies. We exclude Fortis from this since the only transaction was an intra day trade on the 29-Jan.

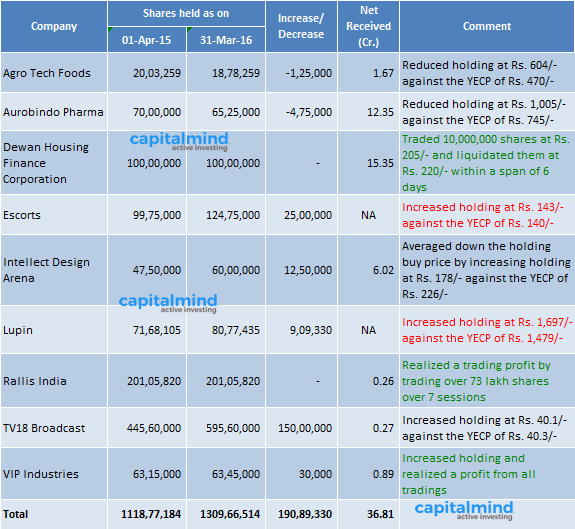

Here is how the performance stood for the remaining 9 invested companies.

- Trading Profits of Rs. 15.61 crore from Dewan Housing Finance and Rallis India. In these two companies, RJ ended up holding the same number of shares at the end of the year as he had at the beginning, but his trades yielded a profit. Some of the larger investors do this often – when they see pockets of overvaluation they sell, and then buy shares back when things calm down.

- He bought more shares of VIP Industries and still made a trading profit Rs. 0.89 crore. This simply means that he realized what he paid for the extra 30,000 shares he bought, plus another 89 lakh in profit through his trades.

- He bought more Lupin shares, 9.09 lakh shares more. It appears he has bought them at higher prices, paying 154 cr. which is effectively a higher price than the year end close.

- In Agro Tech Foods, he sold 1.25 lakh shares effectively at Rs. 604 after which the stock has fallen 20%.

- He bought 12.5 lakh shares in Intellect Design, and still made a profit trading in the shares, of Rs. 6 crore. That’s like getting paid to buy shares!

- Net received from these trades stood at Rs. 37 crore.

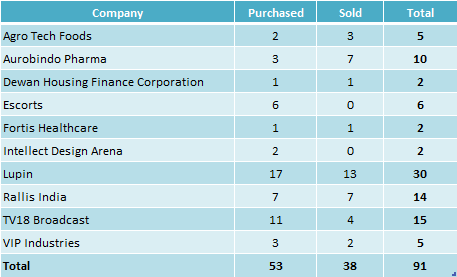

Here is how the trades spanned across each stock:

- Not surprisingly, Lupin remains the most traded stock along with the stock which accounted for the most of the portfolio losses, and where he has a very large holding.

- TV18, Rallis and Aurobindo Pharma were the next higher traded stocks.

Not Exhaustive

Obviously, this is not exhaustive. Many companies only reveal transactions of their top holdings, and RJ may be a smaller shareholder in many companies. And then, we don’t know what other accounts he might have traded from (he also owns Rare Enterprises etc.). But this gives you an indication of what’s happening with some of his larger holdings.

Hope you have found this article useful. Do leave your feedback in the comments section below.

Disclosure: We may have advised some of the stocks as part of our premium portfolio’s and have market positions in them. Please assume we are biased.

You can view the complete portfolio of Rakesh Jhunjhunwala’s holding and 30 other Big Whales in our report here: Portfolios of Top Investors in Indian Stock Market – Big Whales Report – June 2016 (For Purchase, Rs. 999 only)

![]()

Disclaimer

Nothing in this newsletter is financial advice and should not be construed as such. Please do not take trading decisions based solely on the matter above; if you do, it is entirely at your own risk without any liability to Capital Mind. This is educational or informational matter only, and is provided as an opinion.