(category)Charts & Analysis

Decoding Long-Term Nifty Returns: The Power of Time HorizonsDecoding Long-Term Nifty Returns: The Power of Time Horizons

Discover how Nifty returns vary dramatically across time horizons and entry points. Our in-depth analysis reveals the pitfalls of short-term thinking and the power of a long-term approach. How our early experience in the market colours, not only our return expectations, but also our perception of risk. Finally, why the enduring motto for investors needs to be "this too shall pass".

Anoop Vijaykumar•

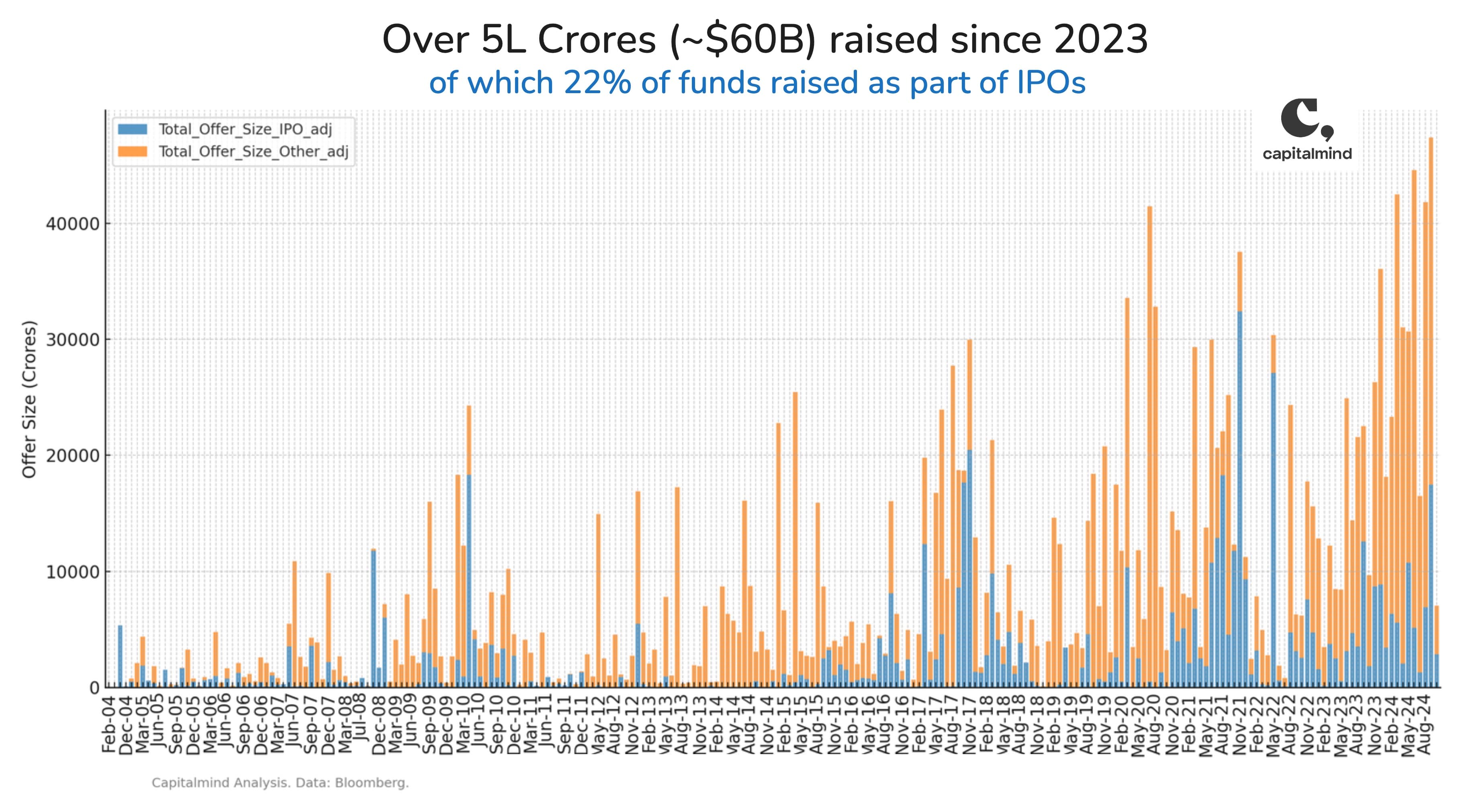

The chart shows annualised returns from investing in the Nifty Total Returns Index (which includes dividends) early each year from its inception. Each column shows the annualised return 1, 2, 3 and so on years from investing in the year represented by the corresponding row. Each column allows for comparing the annualised return at the same timeframe from investing in different years. For example, the "10” column shows the 10-year annualised return from investing every year from 1999 to 2015. Investments after 2015 have completed not 10 years yet and are therefore blank.

The Perils and Potential of Entry Timing

The data starkly illustrates the substantial impact entry timing can have on returns, especially in the short term. Investors who unfortunately entered at market peaks, like the cusp of the 2008 financial crisis, faced a sea of red in the following years as portfolios bled value. Conversely, those who strategically or luckily invested during market corrections or in the aftermath of downturns often enjoyed a rocket-ship ride as the market rebounded.

One Market: Multiple Realities

Investors starting their journeys at different historical points would have had vastly different perceptions of risk and return just a few years into their investments. Consider the early years of five investors through time.

The 2000 ‘The stock market is rigged’ Investor

The dawn of the new millennium was a tumultuous time for the 2000 investor. The dot-com bubble burst, followed by the 2001 crash, would have quickly tempered any initial enthusiasm. After three years, the investment was still deep in the red before beginning a recovery in 2004, which flipped the return to a respectable, although far-from-spectacular, 7%. This investor carries scars from the early beatings, making him forever wary.

The 2003 ‘2x every 2-3 years, at least’ Investor

Entering after a downturn, the 2003 investor enjoyed several years of spectacular returns as the market rallied. After 3-4 years in the market, the 2003 investor sees stocks as an exciting, fast wealth-building exercise, probably leaving them unprepared for the 2008 crash and its aftermath.

The 2008’ Even break-even is bliss’ Investor

Investing just before the financial crisis, the 2008 investor has a baptism by fire. Watching their portfolio plummet early in value would have been a test of resolve. The market grinds down, losing nearly 60% in the first year of their investment, but then rebounds in 2009, then flatlines for the next two years leaving them disoriented about what to expect from markets.

The 2018 ‘Lucky if you beat inflation’ Investor

Entering after a few years of solid returns, the 2018 investor comes with a strong sense of security. She looks forward to high double-digit returns, maybe even better, if she can find the right mid- and small-cap portfolio (The equivalent charts for the Nifty Midcap150 and the Smallcap250 are at the end of this post). But it turned out 2018 is terrible for small-caps as the Nifty alone bucks the trend to about stay above water. After muddling about for nearly two years, the 2020 pandemic crash further makes this investor yearn for the safety of fixed deposits.

The 2020 'BTFD or Bust’ Investor

Entering a sleepy market, the 2020 investor sees a pandemic hit and creates a savage correction that reduces prices by 40% in a few short weeks. There is uncertainty of the kind even market veterans haven’t seen before. Then the money printing begins, and stocks, among other assets, see a rocket-fueled rally. A surreal remote-working locked-down world offers few entertainment outlets. Everyone works with an eye on the open brokerage account tab while attending Zoom calls. Then the world limps to normal, and stocks lose some fizz, but only a little. Making money looks easy.

When you start doesn't just affect your returns, it also rewires your risk perception.

The Beacon for Long-Term Investors: This too shall pass

If you pan over the graphic, one thing that stands out is how annualised returns converge into a narrower range after the 10-year+ mark, irrespective of the wild variation in the early years.

Since the numbers represent annualised returns, this implies that the typical big year, up or down, is followed by moves in the opposite direction. Over time, supernormal returns of the 20-30% kind inevitably moderate downwards. The lesson is simple: if you’ve had mega years early on, moderating subsequent expectations, at least for the next 2-3 years, will help avoid unrealistic net worth projections and subsequent disappointment.

The reverse also applies. The frustration of barely-there returns in the initial years tends to be followed by productive years that normalise a lot of the disparity between lucky and unlucky investors.

This graphic should instil confidence in investors constructing long-term portfolios.

Whether recent investment returns have been too good to believe, or too hard to endure, just remember - this too shall pass.

The Strategic Investor’s no-frills Playbook

Distilling these insights into actionable strategies, a playbook emerges for the strategic investor:

- Embrace a long-term horizon: Extend your time frame to 10+ years to smooth out volatility and capture the market’s innate tendency to rise.

- Diversify across time: Use SIPs or periodic investments to navigate volatility and mitigate the risk of poor entry timing.

- Stay invested through downturns: View market pullbacks as opportunities rather than threats. Being able to actively manage risk as a core part of your investment framework is certainly nice to have

- Avoid euphoric entry points: While perfect timing is impossible, sidestep investing at frothy market peaks. Seek out relative undervaluation.

- When in doubt, index: The Nifty’s consistent long-term returns make index funds an appealing core holding for long-term portfolios.

As investors’ experiences across the decades show, the path to successful investing is often paved with short-term volatility and uncertainty. Yet, those who embrace a long-term perspective, stay disciplined in their approach, and ride out the inevitable downturns are often handsomely rewarded.

While the market’s short-term twists can be unnerving, history tells us that patience, discipline, and strategic investing are often the surest paths to long-term financial success. As the Nifty’s annualised return data so eloquently shows, it’s not just about timing the market, but about the time you spend in the market that truly counts.

Appendix - Midcaps

Appendix - Smallcaps

Speak with a Capitalmind Client Advisor about a customised investment strategy consultation to see if Capitalmind PMS / AIF fits your long-term investment needs.

Related Posts

Make your money work as hard as you do.

Talk to a Capitalmind Client AdvisorInvesting is not one size fits all

Learn more about our distinct investment strategies and how they fit into your portfolio.

Learn more about our portfoliosUnlock your wealth potential

Start your journey today