Resilient

Powered by our quantitative model, Capitalmind Resilient analyzes the universe of investable securities to identify quality companies with steady profits and lower price volatility.

Strategy Overview

A quantitative portfolio approach built by combining profitability and price volatility factors, rebalanced quarterly.

Key Features

Quantitative Portfolio Selection

Our algorithm scores and ranks the universe of investable stocks on a composite metric quantifying price volatility and fundamental quality factors and allocates to the stocks in the top-decile.

Consistently profitable "low surprise" companies

The combination of low price-volatility and fundamental factors unearths companies with steady underlying performance with potential for steady future earnings growth making Resilient suitable for significant long-term allocation

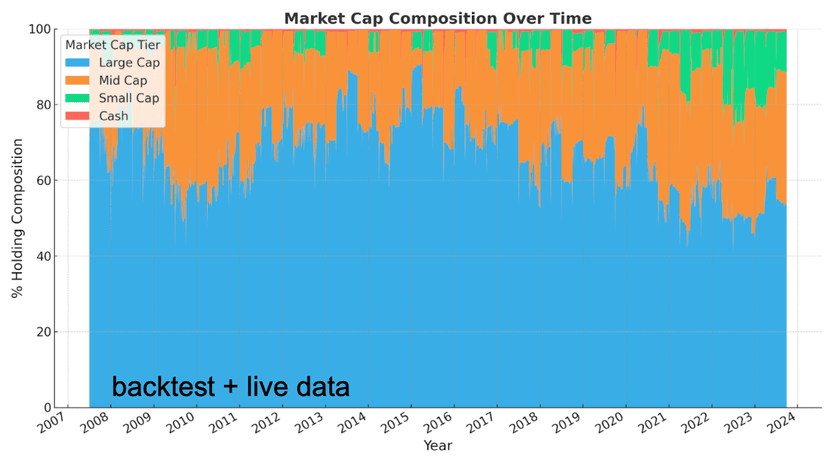

Large cap core with addition of mid and small caps

Consists of strong core of large cap stocks with prudent mix of mid and small caps when appropriate to offer potential for strong long-term performance

Globally Researched and Proven, by academics and practitioners

Robust, Dependable Portfolio Construction

Large and Mid-Cap Concentration of Profitable Companies: Primarily holds large and mid-cap stocks with selective allocation to small-caps offering a stable foundation. In backtests over 15 years and live performance, show the portfolio holds high-quality companies with steady earnings and profitability.

Behavioral Drivers of Low Risk Investing

- Investor overconfidence: Tendency for investors to favour more volatile because they overestimate ability to pick winners

- Attention grabbing stocks: Investors tend to gravitate towards stocks in the news or with extreme recent price moves

- Preference for lottery-like payoffs: Drives up prices of high-volatility stocks thus lowering future returns of high-volatility stocks conversely raising them for low-volatility stocks

Rigorous & Iterative Process

First-principles Approach

At Capitalmind we apply an iterative three-step Validate-Build-Deploy methodology of going from initial hypothesis to investable strategy, rigorously testing potential approaches before they are deployed.

Getting the right data and the data right

We ensure our backtests are replicable, using high-quality input data that is free of survivorship bias,accounts for corporate actions, and are realistic by considering point-in-time liquidity constraints to arrive at realistic backtest outcomes.

Combine proven research with Original problem-solving

We start from comprehensive research by academics and reputed practitioners, then add our insights and market experience to develop robust quantitative strategies that work in the Indian context.

Continuously Improving and Evolving

Our investment models undergo systematic evolution, driven by testable hypotheses. Applied over historical market cycles to separate signal from noise and incorporate durable improvements.

Capitalmind Resilient (erstwhile Low Volatility) Performance

Inception Date: 2021-09-06

Returns are net of fees and transaction costs. Returns for periods >1Y are annualized.

Performance data is not verified by SEBI.

Last updated: 2026-02-23

Downloads

Find the detailed presentation for more on the Capitalmind Resilient Strategy

Frequently Asked Questions

What is the universe of stocks in which Resilient invests?

The universe is all investable stocks listed on the NSE. Only stocks meeting the liquidity criteria in terms of average traded values are considered. Typically, this means allocating to the top 250 stocks by market cap with a few exceptions outside of those.

How do you ensure your backtest results are realistic?

Poorly constructed backtests lead to inaccurate or just plain wrong conclusions. Our in-house backtesting framework mitigates the biggest issues that afflict backtests. Two examples for illustration, the base data is survivorship-bias-free and validated through multiple checks. Incorporating point-in-time liquidity data constraints ensures only positions possible in a real-world portfolio.

What are the reasons NOT to invest in Resilient?

There are four reasons: 1. Buys “unexciting” stocks - usually when there’s little buzz 2. Higher turnover (~1x each year) compared to buy-and-hold 3. Excludes financials because their fundamentals are comparable to non-financials 4. Trails mid and smallcap-led portfolios during out-and-out bull markets

What is the fee structure for Resilient?

Capitalmind PMS charges a fixed 1% of AUM as fee for Resilient. We do not charge a percentage of returns made. In addition, there is zero entry or exit load. Download Fee calculator here

Connect with our Client Advisory Team

Get your customised strategy consultation on how Resilient can fit into your long-term investment plan.

SEBI Regd. Portfolio Manager : INP000005847